What will it cost?

SEEK INDEPENDENT FINANCIAL ADVICE

As with any significant investment in your life, it is important to seek the advice of an expert. If you already have a financial planner or adviser, you’re one step ahead.

If you don’t have an adviser or can’t afford one, there are a few places you can go to help you get a sense of whether you are in good financial shape for retirement.

› ASIC’s MoneySmart: ASIC’s consumer website, www.moneysmart.gov.au can help you work out how much money you will need for the life you want. The budget planner can help you take stock of your present and future spending, while their retirement planner estimates the income you are likely to get from your Super and the Age Pension.

› Department of Human Services (DHS): A DHS Financial Information Service officer can estimate how much Age Pension you will get and help you make sense of your options. www.humanservices.gov.au

There are also a number of other calculators and resources available freely online.

IMPORTANT THINGS TO CHECK BEFORE YOU SIGN

Before you sign anything, make sure you check on a few key things.

- What does your entry payment actually include? Does it just cover the cost of your home or does it include service charges?

- Ask what the weekly or monthly service charges actually are for your village. Check what services are included in this fee – and what services are not.

- If the village has a gardener or a bus, do you need to pay for these services as extras or are they included?

- What are you obliged to do if you want to sell your home and move out? Are there costs involved? If so, what are they?

- Are you required to replace carpets/floor coverings, curtains, heaters or kitchen or laundry appliances if you decide to leave the village? Or are these already covered?

- Do you need to pay out any fees or charges if you decide to leave the village earlier than you were expecting?

- If you leave the village, are you required to pay service charges for a period?

It’s important to be entirely clear what is included and what is an additional charge. And remember – if you’re eligible, you may be able to access funding for some services through the Commonwealth Government Home Care Packages Program.

When you do your budget, allow for increases each year at least in accordance with CPI, plus your own power, rates and water.

That should start to give you a reasonable picture of your overall spend.

DEFERRED PAYMENT FEE

This is an important fee with several names – deferred management fee (DMF), departure fee, exit fee, deferred fee, retention amount, or outgoing payment. Different terminology is used in different states and territories, and by different village operators.

KEY THINGS TO KNOW:

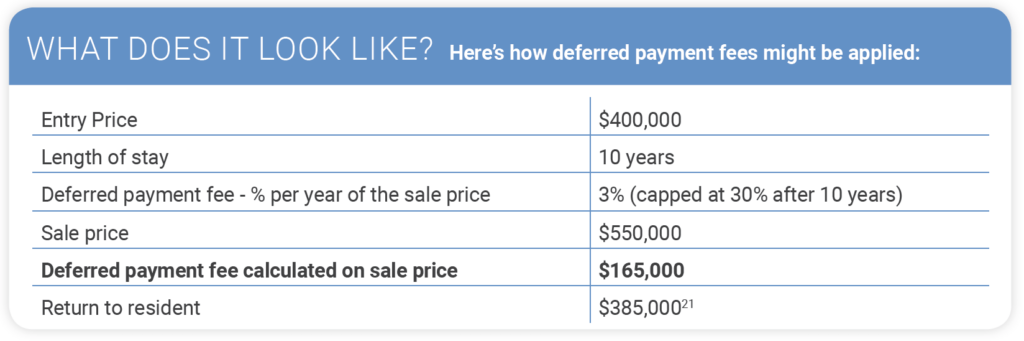

A deferred payment fee is payable when you leave the village, in most cases when your unit is resold or re-let. In the latter situation, the fee is generally deducted from the amount you receive from the sale.

The deferred payment fee is usually calculated as a percentage of either the entry payment you paid or the resale/re-let price the new resident pays. You will find this percentage, and which payment it is calculated upon, in your contract. Be sure to look for it specifically.

Generally, it is accrued throughout your tenure, meaning you pay more the longer you stay, but it is generally capped after a set period.

The calculation method varies between operators, and may even vary within a village, as different residents opt for different payment options.

The amount you agree to pay upfront (the entry payment) or upon leaving (the deferred payment fee) can also alter the share of capital gain you’re entitled to. When entering your residence contract, you and your village operator will need to agree to a deferred payment fee that you both consider fair, and a reflection of the value of village life.

Example

21 This figure does not include other costs which may be payable upon exit e.g. advertising or estate agent costs, reinstatement costs. It also assumes that the resident’s contract agrees that 100% of any capital gain will be paid to the resident, which can vary depending on your village operator.

CAN I GET A MORTGAGE?

You may be wondering if it’s possible to take out a mortgage to fund your retirement village purchase.

The short answer is possibly, but highly unlikely. It can depend on several things – the type of property, your contract with the village operator, and how willing your bank is to provide the finance.

Anyone who purchases a village home under a lease or licence arrangement doesn’t own the title to the land. On this basis alone, it’s not possible for them to take out a mortgage with the land title as security.

A person who buys a strata title unit is (in theory) able to take out a mortgage to help fund the purchase price. However, if that unit is within a retirement village, the operator would have most likely already have a caveat imposed on the title to secure your payment of the deferred payment fee when you leave the village.

This caveat would take precedence over any mortgage arrangement you have. This means that any mortgage provided by a bank or other financial institution would in effect become a second mortgage. That usually pushes it beyond the comfort level of most lenders. And there is often additional concern that should it become necessary for the bank to sell the property, it may be more difficult to sell than your typical family home.

Despite this, some banks may consider lending a portion of the entry payment in exchange for a mortgage. But again, this is very rare.

GOVERNMENT ASSISTANCE

When you move to a retirement village, the amount you pay as an entry payment can impact your eligibility to access government assistance such as the Age Pension and rent assistance.

The following definitions are handy to understand if you’re dealing with Centrelink about eligibility for assistance:

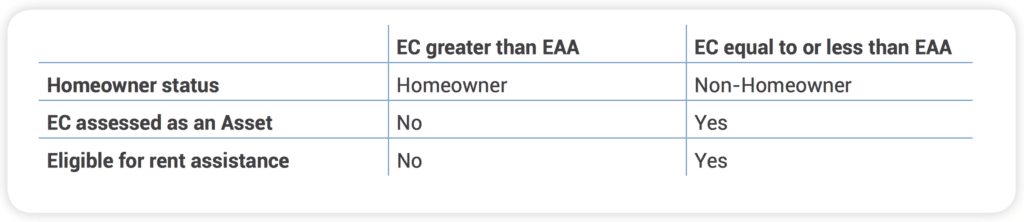

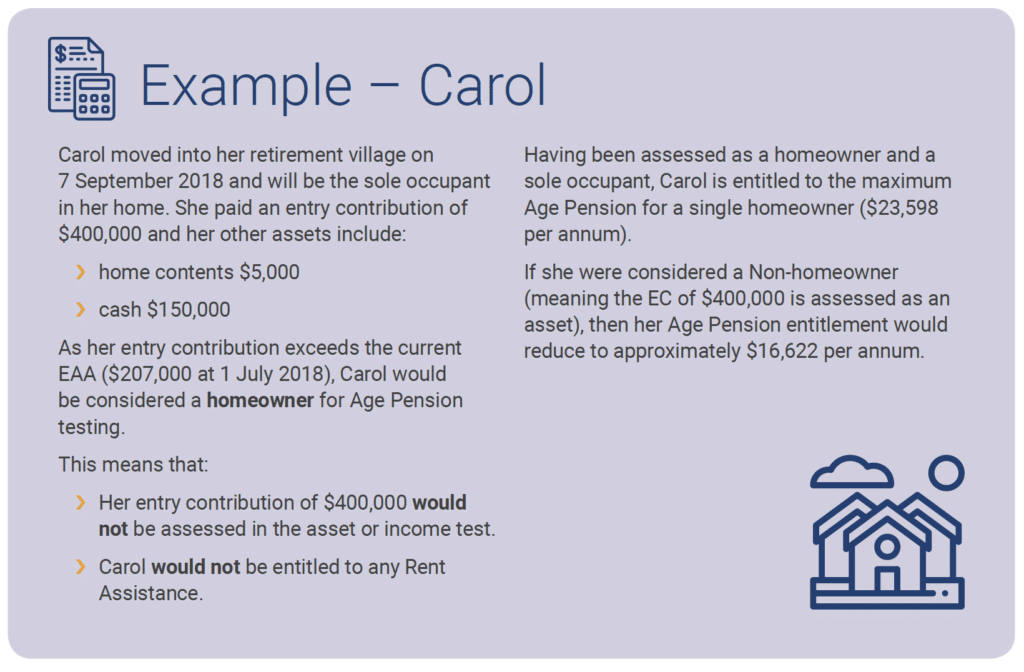

› Entry Contribution (EC) – This is the amount you pay to enter your retirement village. This amount determines your home ownership status and your eligibility for rent assistance.

› Extra-Allowable Amount (EAA) – This is the difference between the homeowner and non-homeowner asset limit rates. At 1 July 2019, this amount was $210,500.

In a nutshell…

RENT ASSISTANCE

Your homeowner status (see above) will determine your eligibility for government-funded rent assistance, which can help to cover your regular service charges.

If, following their assessment, Centrelink considers you to be a non-homeowner, your service charges are viewed as rent and, as long as you meet all the other eligibility requirements, you may be able to claim rent assistance.

AGE PENSION

If you are receiving the Age Pension or intend for this to fund your retirement, you should be clear on whether a move to a village will impact your pension and to what degree. As is the case with rent assistance, whether Centrelink considers you a homeowner also affects the amount of assets you can own without affecting your pension payments.

If you’ve been receiving a full pension in your current home, and you sell your house but don’t spend as much on your retirement village home — that extra money from the sale of your house will count in your Age Pension asset test. Depending on your total asset figure, your pension may be impacted.

However, all is not lost! Remember earlier we explored retirement village entry and exit payments? Some village operators may be happy to negotiate on how much you pay up front or upon departure.

Sometimes paying more up front in your entry payment, and less in your deferred payment fee can preserve your pension rate – or ensure that when you do start receiving it, you are getting the most that you can.

It’s important to consider all of these things in line with your lifestyle goals. Perhaps having some cash put aside for a holiday is a key part of your plan. It’s a wise move to think about all of these things when you’re planning your retirement move and your finances.

Make your wise move